The State of the Semiconductor Industry and Its Growth

Kristi Perkins, MBA, Industry Account Manager, Automation Solutions Expert

Posted 11/21/2024

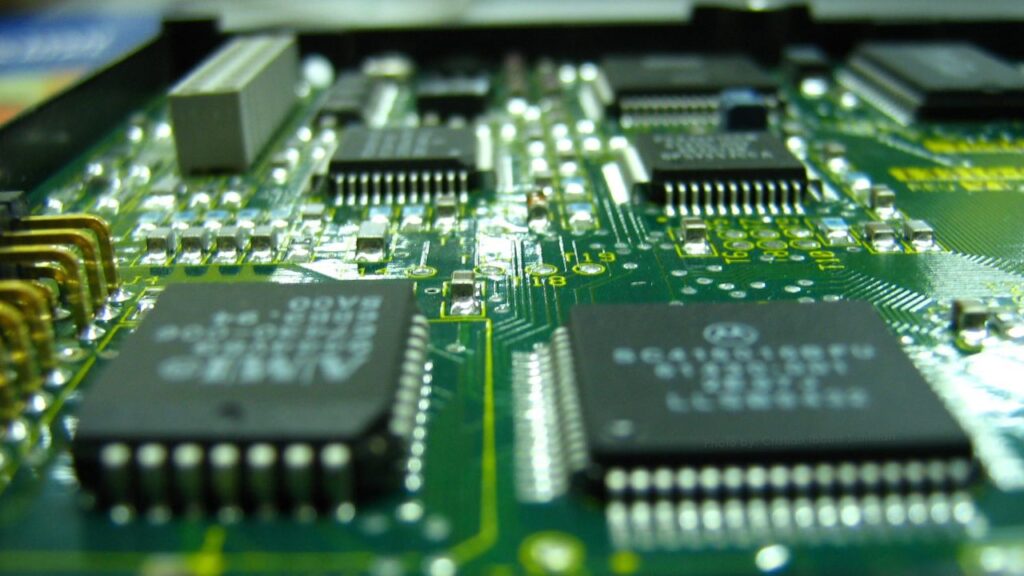

The semiconductor industry is a cornerstone of modern technology, enabling innovations that make the world smarter, healthier, greener, and better connected. Semiconductors, often referred to as the “brains” of electronic devices, are integral to everything from smartphones and computers to advanced medical equipment and electric vehicles, as well as less common household items like refrigerators, dishwashers, and our smart bulbs to connect devices to Alexa or Siri.

Struggles in 2021 and 2022: “The Great Chip Shortage”

The semiconductor industry faced significant struggles in 2021 and 2022 due to a global chip shortage. The COVID 19 pandemic caused unprecedented disruptions in supply chains, leading to a surge in demand for semiconductors as people relied more on technology for remote work, education, and entertainment. This sudden increase in demand, coupled with supply chain issues, resulted in a massive gap between supply and demand.

In the dire straits of the chip shortage, I witnessed customers going to extreme lengths, some even digging for microchips in used equipment like old dryers to repurpose chips for their products. This resourcefulness highlighted the desperate measures companies had to take to continue production amidst the severe shortage.

During this time, I was working for an electronics manufacturer of medical, industrial, and commercial devices. Our in-house buyers were seeking to purchase chips on the gray market from companies such as Arrow Electronics, AVNET, and DigiKey. We experienced soaring prices on legacy chips, not even high-end chips used in AI. Before the shortage, prices were around $3 each then shot up to a staggering $500 each. This situation forced companies to find alternative suppliers, redesign products to use fewer chips, and even delay product launches. The cost associated with the increase was passed down to the customer and to the end user – the consumer.

Current State of the Semiconductor Industry

In recent years, the semiconductor industry has experienced significant growth and transformation. Despite a cyclical market downturn early in 2023, global sales rebounded in the second half of the year, reaching $527 billion. The industry sold nearly one trillion semiconductors globally, highlighting the critical role these tiny components play in the global economy.

The artificial intelligence chip market is currently experiencing robust growth, as evidenced by Taiwan Semiconductor Manufacturing Co.’s (TSMC) latest financial results. TSMC report ed a 54% surge in profits for Q3 2024 driven by soaring demand for AI server processors. This positive performance has instilled confidence in the market, leading to a rally in several AI stocks.

Nvidia saw its stock reach an intraday high of $140.89 on Thursday (DATE), although it closed slightly lower at $136.93. Despite this, Nvidia’s stock remains near its record high. Advanced Micro Devices (AMD), on the other hand, ended the day flat after giving back most of its gains. Broadcom and Micron Technology also experienced gains, with their stocks rising 2.7% and 2.6% respectively, though both came off their intraday highs.

TSMC’s CEO, C.C. Wei, highlighted the company’s strong AI related demand, noting that revenue contribution from AI server processors is expected to more than triple in 2024, making up a mid-teens portion of overall revenue. This optimistic outlook reflects the sustained interest and investment in AI technologies across the industry.

However, not all segments of the semiconductor market are faring equally well. ASML Holding NV, a major player in the semiconductor manufacturing equipment sector, reported disappointing third quarter earnings, leading to a broad selloff across the industry. ASML CEO Christophe Fouquet noted that the market’s recovery is expected to extend well into 2025, citing slow demand recovery in the automotive, mobile, and PC markets, despite strong AI-related server demand.

ASML has faced significant challenges, including a sharp decline in share value and pressure from geopolitical tensions. The company, which produces the world’s most advanced chipmaking machines, has experienced a notable decrease in bookings and has slashed its earnings guidance. Fouquet also highlighted the cautious investment behavior of customers and adjustments to short-term investment plans to match market conditions.

The situation is further complicated by geopolitical factors, with the U.S. and its allies increasing pressure on China to limit access to cutting edge chip technology. China has been ASML’s largest market for the past five quarters, but new export control rules and potential further restrictions have led ASML to take a more cautious view on its business in China.

Supply Chain Rebalancing

Strengthening American and global semiconductor supply chains remains a top priority for the U.S. semiconductor industry. Companies are working to diversify risk by broadening their operational footprint. Governments have also taken a particular interest in advancing supply chain resilience, aiming to reduce strategic dependencies. The CHIPS and Science Act allocated $500 million to the International Technology Security and Innovation (ITSI) Fund to help expand and diversify segments of the semiconductor supply chains such as critical materials and assembly, testing, and packaging.

Global Partnerships and Investments

The U.S. has established partnerships with Costa Rica, Panama, Vietnam, Indonesia, the Philippines, and Mexico under the ITSI Fund. Additionally, the U.S. and Japan are pursuing cooperative efforts to enhance semiconductor supply chain resilience through initiatives like the U.S.-Japan Commercial and Industrial Partnership (JUCIP) and the U.S.-Japan University Partnership for Workforce Advancement and Research & Development in Semiconductors (UPWARDS) initiative. Similarly, the U.S. and South Korea have deepened collaboration on technology and economic security policies, establishing a semiconductor-specific working group to enhance industry supply chains and promote joint R&D efforts.

Through the Trade and Technology Council (TTC), the U.S. and the European Union (EU) are cooperating to improve the resilience of transatlantic semiconductor supply chains and facilitate information exchange on government incentives provided to the semiconductor sector. In May 2023, the U.S., Canada, and Mexico established the North American Semiconductor Conference to collectively strengthen the North American semiconductor supply chain, including critical minerals and workforce development.

Governments around the globe are also developing comprehensive strategies and offering targeted incentive packages to attract semiconductor investment. China, the EU, Japan, South Korea, Taiwan, and India have announced substantial investments and support packages to bolster their domestic semiconductor industries.

The Semiconductor Workforce

Having a competitive domestic workforce and resilient manufacturing capabilities are critical to America’s lead in semiconductors. The semiconductor industry has a considerable economic footprint in the United States, with roughly 338,000 people working in the industry, including roles in chip design, electronic design automation (EDA), semiconductor manufacturing, and equipment manufacturing. Additionally, semiconductors enable over three hundred downstream economic sectors accounting for over 26 million U.S. workers.

The U.S. semiconductor industry accounts for more than 300,000 direct U.S. jobs and nearly two million additional indirect and induced U.S. jobs, demonstrating its significant impact on the overall economy.

Expanding the Talent Pipeline

With demand for chips on the rise and new capacity coming online in the years ahead, demand for industry-ready talent will also increase. According to a 2023 study by SIA and the Boston Consulting Group, the United States faces a significant shortage of technicians, computer scientists, and engineers¾ with a projected shortfall of 67,000 workers in the semiconductor industry by 2030 and a gap of 1.4 million such workers throughout the broader U.S. economy.

To meet this challenge and address the growing talent gap, SIA recommends a holistic public policy approach with the following pillars: (“SIA 2024 State of The U.S. Semiconductor Industry Report”)

1. Build the Supply of Engineers and Scientists:

• Invest in the Innovation Workforce: Increase and sustain funding for federal research and development (R&D) programs to build America’s innovation workforce.

• High skilled Global Talent: Adopt critical and targeted STEM immigration reforms to ensure America attracts and retains the world’s top talent.

2. Improve and Simplify Training of Skilled Technicians:

• High quality Workforce Training: Expand workforce training programs that meet industry needs, including apprenticeships and career and technical training programs with common and transparent metrics of performance.

• Standardization and Portability of Skills: Ease the transition across educational institutions and workforce development programs.

Growth and Future Prospects

The semiconductor industry is projected to continue its upward trajectory, with global sales expected to exceed $600 billion in 2024. This growth is fueled by increasing demand for semiconductors in various sectors, including artificial intelligence, autonomous driving, electric vehicles, and advanced wireless networks.

The industry’s aggregate annual growth rate is estimated to average between 6% to 8% per year up to 2030, potentially reaching a trillion-dollar market by the end of the decade. This growth will require significant investment in advanced wafer manufacturing materials, equipment, and services, as well as in back-end assembly, test, and packaging solutions.

Key Drivers of Growth for the Semiconductor Industry

Several factors are driving the semiconductor industry’s growth. The rise of digital transformation and the increasing reliance on technology in everyday life are major contributors. Additionally, the push for sustainability and energy efficiency is driving demand for more advanced and efficient semiconductor solutions.

The semiconductor industry is also benefiting from government initiatives, such as the CHIPS Act in the United States, which aims to boost domestic semiconductor manufacturing and reduce reliance on foreign supply chains. These initiatives are expected to further stimulate growth and innovation in the industry.

Conclusion

The semiconductor industry is at a pivotal point, with significant opportunities for growth and innovation on the horizon. Despite the challenges, the industry’s resilience and adaptability are driving its continued success. As technology continues to evolve, the demand for semiconductors will only increase, making this industry a key player in shaping the future of our digital world. After the recent election, there may be uncertainty within the market as the outcome could affect long-term investments from the CHIPS and Science Act.

Sources:

• The CHIPS Act: How U.S. Microchip Factories Could Reshape the Economy |Council on Foreign Relations (cfr.org)

• Government-Incentives-and-US-Competitiveness-in-Semiconductor-Manufacturing-Sep-2020.pdf (semiconductors.org)

• Fact Sheet: Arizona Semiconductor Industry (nist.gov)

• SIA_2024_State-of-Industry-Report.pdf (semiconductors.org)

• ASML cuts forecasts in Q3 earnings published early; shares fall (msn.com)

• ASML CEO Sees Slow Chip Recovery Extending ‘Well Into 2025’ (msn.com)

• Nvidia’s stock pares gains, failing to clinch record close despite TSMC optimism (msn.com) (“Nvidia’s stock pares gains, failing to clinch record … – Morningstar”)

Kristi Perkins

Kristi Perkins, a dynamic professional wielding an MBA from Eastern Washington University. At the forefront of Rockwell Automation's triumph, Kristi specializes in revolutionizing the semiconductor industry. With a keen focus on empowering clients to elevate their production and automation prowess. Kristi is also a proud member of the International Society of Automation – Smart Manufacturing Group, amplifying her influence in cutting-edge advancements.

Related Articles

OEE: Overall Equipment Effectiveness

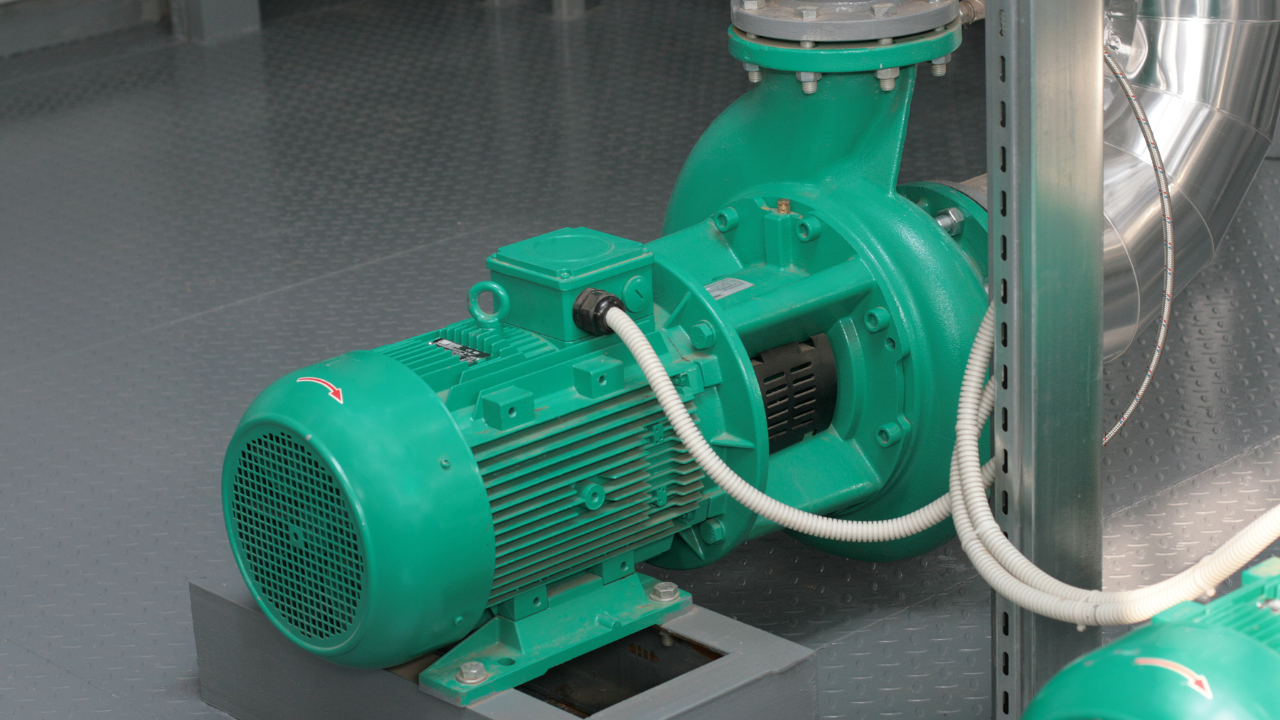

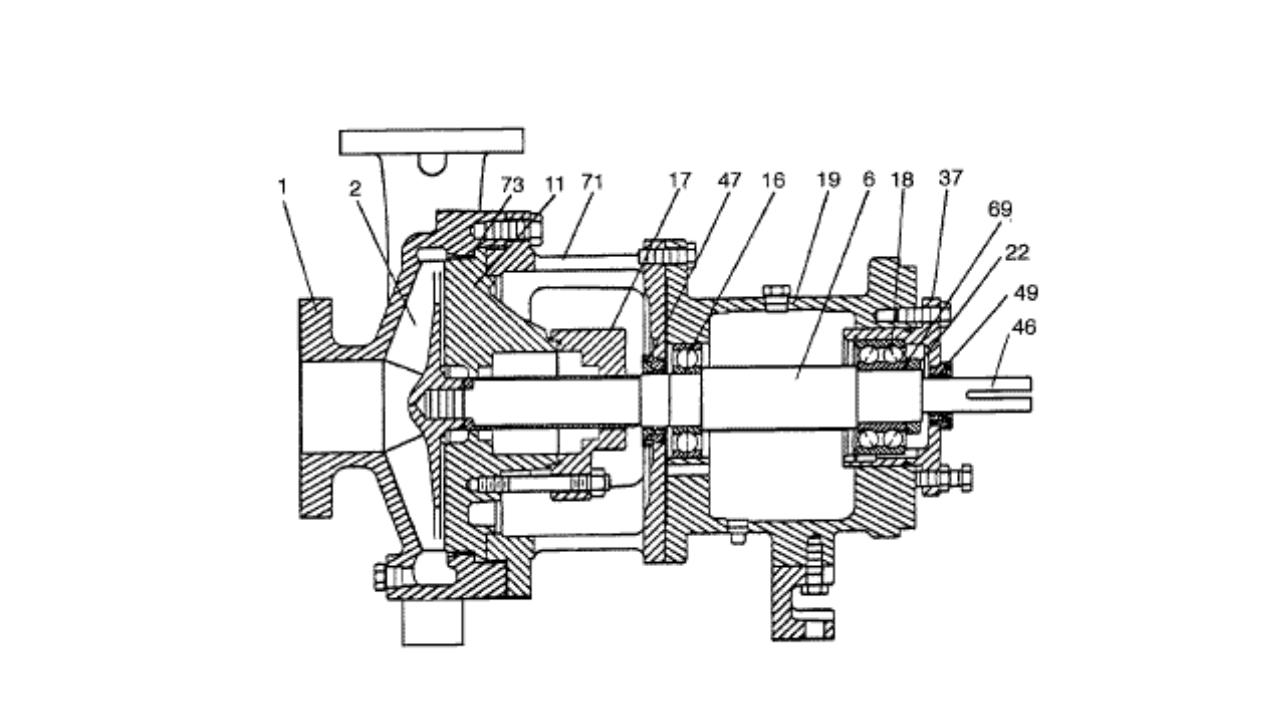

What the Pump Was Designed to Do and Why it Doesn't Do it

What is Wrong with the Modern Centrifugal Pump?

Digging Up Savings: Go with the Flow

Chain Drive Design Recommendations

Classifying Chemicals to Assure Effective Sealing