ERP and EAM: Partners, Not Competitors

At times, this debate has been contentious, pitting one department or function against another, with the winner being, in many cases, who can yell the loudest or who has the most sway with top executives. The key participants in the ERP vs. EAM debate are most often finance, IT and operations.

Historically, IT and finance prefer the ERP approach. With ERP, IT has fewer applications to support and finance has a one-stop shop for the organization’s financials. Operations, on the other hand, likes the EAM approach, as it offers rich functionality, ease of use and better reporting tools.

So, who is right? Which software system should an organization use to manage its assets?

Organizations that rely on their assets to accomplish their business objectives should take this question seriously. Choosing the right software tool is critical to achieving and sustaining success. To better answer this question, it is always best to begin with the basics by defining exactly what each system is designed to do.

Defining ERP and EAM Systems

ERP is business management software that allows an organization to use a system of integrated applications or modules to manage its activities. ERP is designed to combine all of a company’s activities into a single database, eliminating incompatible and duplicate technologies.

EAM is a broad term used to describe software specifically designed to manage an organization’s physical assets (e.g., buildings and equipment). EAM systems are used by asset management functions, like engineering, maintenance, operations, MRO materials management, purchasing and accounting, to capture and track asset lifecycle activities.

Comparing ERP and EAM Systems

At first glance, particularly at the executive level, choosing an ERP system to manage physical assets looks pretty enticing. There is only one software system to support and the data is all in one place; a finance and IT heaven. In recent years, many organizations have bought into this approach.

This movement towards one system to “do it all” conjures images from the 1950s movie, The Blob, where a giant amoeba-like alien from outer space terrorizes a small community by assimilating and consuming everything in its path. In this case, the blob is ERP software modules, gobbling up all the critical business functions, including asset management.

This approach is unfortunate. ERP is a great fit for functions like IT and finance and can do an excellent job of managing an organization’s finances. However, it places other critical operations, like asset management, at a disadvantage. ERP systems can be difficult to use and difficult to implement.

When it comes to asset management—a key driver of an organization’s financials and the guts of the operation—an organization needs tools that are easy to configure and deploy, and have robust reporting capabilities; that is, everything that EAM systems offer.

In many cases, when asset management operations are forced into using an ERP system, they end up in the back of a slow-moving implementation line with the rest of the organization, waiting for their turn to go live. Then, once live, they are stuck with a tool that offers less functionality and is harder to use. Getting less and having to wait longer to implement place asset management operations at risk. For asset-dependent organizations, this risk is unacceptable.

However, the tide is turning. Organizations are now beginning to realize that the ERP onestop shop approach might be shortsighted, that it is difficult, if not impossible, for one software system to optimally serve the needs of the entire organization. A more balanced approach is required where critical functions, like asset management, get the tools they require, while finance and IT get the consolidation and system simplicity they need.

Delek Refining, a division of Delek US Holdings, operates two oil refineries with a production capacity of more than 140,000 barrels per day. Delek was recently involved in a comprehensive asset management software evaluation and selection process. They compared best-in-breed EAM systems against comparable ERP system modules, focusing on functionality, ease and efficiency of use. Key areas evaluated included system navigation, asset management, work management, planning and scheduling, asset reliability, shutdown coordination, capital project tracking, inventory management, purchasing, vendor management, accounts payable and reporting.

On a scale of 200 possible points, the evaluation revealed the following scores:

| Software | Functionality Rating | Ease of Use & Efficiency Rating | Totals |

| EAM | 83 | 80 | 163 |

| ERP | 77 | 61 | 138 |

Delek chose to go with an EAM system over an ERP system to manage its assets. Frank Simmons, vice president, Refining Best Practices at Delek Refining, put it best:

“Asset management is a top priority for us. We rely on our assets to be successful. Therefore, we want the best when it comes to technology tools that can help us accomplish our goals. Tools that offer rich functionality, are easy to use, easy to integrate and don’t break the bank in the process. The EAM system met this criteria and was the best choice for us.”

So it’s a no-brainer, right? The numbers clearly show that EAM systems are better than ERP system modules for managing an organization’s assets. Why should anyone choose to manage their assets with anything but an EAM system? Well, not so fast.

Integrating ERP and EAM Systems

There is one word that has spread fear and terror into the heart of IT and finance departments since the beginning of software time: integration. Integration is the act of bringing two or more systems together to share data.

ERP systems normally manage the organization’s financials. By using an EAM system, a portion of those financials—those related to asset management activities (e.g., MRO purchasing)—are initiated and tracked in the EAM system. To ensure costs are correctly allocated across the chart so accounts and vendors are paid, cost information must be passed to the ERP system. The two systems must be integrated.

This is where it gets sticky. EAM and ERP system integrations have been historically complex and expensive. Different types of databases, table structures, upgrade issues and system constraints have added costs and headaches to getting EAM and ERP systems in sync and communicating. The difficulty associated with system integration is the primary reason why some organizations have chosen ERP over EAM when it comes to asset management.

However, times are changing. Three recent developments have made system integration easier and even desirable:

- Rapid advancements in technology;

- Improved understanding of where certain business processes should reside;

- Rationalizing the flow of information between systems.

Technology Advancements

Traditionally, middleware applications (i.e., software that connects two or more systems) have been extraordinarily complex. Often, these applications were custom developed by outside resources using somewhat disjointed estimations of how the interfaces will work once everything goes live. Then once the switch is thrown, necessary changes are subject to the bureaucracy of the support model, rather than the usually leaner iteration model.

Now, middleware technology, like ERP and EAM, is evolving to enable non-technical resources to manage document flows. This means that more and more, middleware tools are embedding elements, like graphical tools for flows, mapping, exceptions handling and so forth. In other words, middleware is evolving into a platform, not just a point-to-point mechanism. This new platform approach enables multiple integration models to exist within the same application. For example, an organization might want a parallel flow for new employee records from ERP to EAM to customer relationship management (CRM), while maintaining a simple point-to-point flow for invoice documents from ERP to EAM, or vice versa.

Flexibility is king in the new integration world. No longer are organizations shying away from using an EAM system because integration with ERP seems too scary. Advancements in technology are making integration easier and less costly.

Business Process Development

Additionally, many of the past complexities of system integration were not only due to the technologies employed, but also where certain business processes reside. Defining where business process will be executed (i.e., EAM vs. ERP) is a key factor of integration success. If overlooked, it could result in a long, expensive and painful integration experience.

Ultimately, organizations should strive to drive their costs to the asset level. Knowing what the organization spends to operate and maintain assets supports informed and educated business decisions. With that said, the most efficient and effective means of capturing asset lifecycle costs is to perform work management (e.g., maintenance and engineering), MRO materials management and purchasing all in one system. These are integrated functions and ideally should have one system home for their activities, preferably the EAM system. Let the EAM system do what it does best, which is to manage the organization’s assets and asset support activities.

Rationalizing Information Flow

One of the goals of system integration is to minimize information flow between systems, while ensuring each function has the information it needs to do its job. This approach simplifies the integration project, lowers integration costs, and reduces ongoing support and risk, while meeting functional business requirements.

If an organization’s current integration looks like a bowl of spaghetti (i.e., lots of bidirectional information flow) and is riddled with duplicate documents (e.g., purchase orders in both systems), then it may be time for it to rethink how best to get the EAM and ERP systems talking.

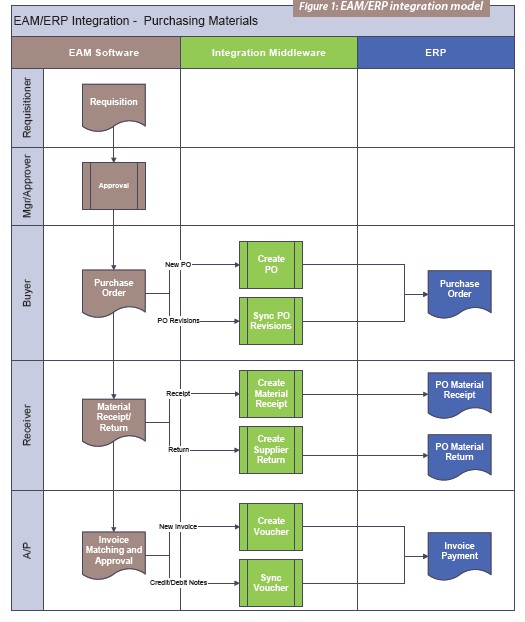

Figure 1 shows a high-level EAM/ERP integration model that minimizes application touch points (the source of many problems), keeps asset management costs and activities tied to the asset, maintains a consistent workflow and information flow, and gives the ERP system what it needs to associate costs to the general ledger to pay vendors.

In the Figure 1 example, MRO materials management, requisitioning, quoting, purchasing, receiving and invoice management are executed in the EAM system. Cost and vendor payment information are then passed to the ERP system. This is consistent with the belief that asset management activities are best performed inside the asset management system and financial reporting and vendor payments are best managed through the financial system.

The reality is that every organization is different. No one integration model, like no one software, is capable of optimally servicing the needs of everyone. There are certainly different ways to accomplish the same thing. But keep in mind, less can be more. Keeping integration simple and thorough keeps costs down, meets business requirements and allows the organization to fully realize the benefits that both ERP and EAM systems can provide.

Conclusion

Asset-intensive organizations need ERP and EAM systems to act as partners to help fully deliver their strategic plan. Both ERP and EAM systems serve distinct, specific and value-added purposes. Each system complements the other by doing what it does best in its respective field. Each system should occupy a prominent place in an organization’s software portfolio.

EAM systems do a better job of managing physical assets. ERP systems are better at managing financial assets. Bring both systems together with an effective integration strategy and let them do what they do best. EAM and ERP systems are partners, not competitors, in the ongoing effort to help organizations accomplish their objectives.

Tracy S. Smith

Tracy S. Smith is a sixteen-year veteran of helping organizations design, implement and improve Asset Management Systems. He is the President of Swain Smith & Company. As a certified and Endorsed Assessor of PAS 55, Tracy delivers PAS 55 auditing and accreditation services. He is a member of the Institute of Asset Management and an active participant in the US Technical Advisory Group aiding in the development of ISO 55000. Tracy’s educational credentials are an MBA from Clemson University with a BS degree from the University of South Carolina / David Lipscomb University.

Related Articles

Too Small for a CMMS? Think Again

The Role of Information Technology in Plant Reliability

The Future of CMMS